Most people are familiar with the figures on US share of world oil consumption versus world oil production: that we produce a mere 3 percent, but consume 25 percent of world oil supplies.

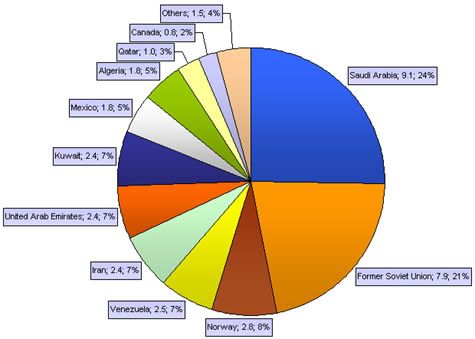

Most people are familiar with the figures on US share of world oil consumption versus world oil production: that we produce a mere 3 percent, but consume 25 percent of world oil supplies.However, there is an even more startling figure, in light of this. Since 2005, the share of world oil resources owned by the various national oil companies has grown by a healthy 15 percent, according to figures from the International Monetary Fund.

Control by Western oil companies such as ExxonMobil, BP Amoco, or Royal Dutch/Shell of the world's oil has plummeted from well over 50 percent 30 years ago down to a mere 7 percent of the world's oil resource base. National oil companies (fully or in the majority owned by a national government) now control the lions share of world oil supplies, and they are also increasingly investing outside their national borders.

Due to this increasing dominance over global reserves, the importance of nationally owned companies relative to international oil companies such as ExxonMobil, BP Amoco, or Royal Dutch/Shell, has risen dramatically in recent years.

Proven reserves are the main asset of an oil company, and to be counted in asset valuation, they only need leases: oil companies don't have to actually drill on them to boost their bottom line on paper.

Perhaps opening up new oil leases is more about being able to increase profits to compete with much larger entities in the new world oil market than about creating a vast new gushing hose of oil to supply the American consumer!

For Matternetwork