Investors are becoming increasingly concerned about potential regulatory risks and economic dangers in a carbon-constrained world

A group of

65 leading US investors with collective assets totaling $7 trillion has teamed up with the European investment management firm,

F&C Investment to put a halt to Wall Street financial regulators softening of the rules on tar sands reserves disclosed by oil and gas companies.

The Investor Network on Climate Risk and F&C Investment are concerned that the escalating risks posed by climate change have broad implications for oil and gas companies which could impact their future earnings, and that these risks fall into the category of known trends requiring company disclosure.

At a time when governments around the world are taking an increasingly hard line on carbon pollution, these investor groups feel it is essential that investors be able to assess accurately the risk profile of reported reserves.

As quoted in the

UK Guardian, Elizabeth McGeveran, senior vice-president of F&C's governance and sustainable investment team said"Understanding climate risk will assist investors in understanding and evaluating reserves. Regulations already require the disclosure of known trends that companies can reasonably expect will have a material impact on net sales, revenues or income from continuing operations, and we believe that the disclosure of any estimated additional risks posed by the extraction and development of additional reserves will be important."

The SEC had been reviewing the regulations on the way reserves are calculated since 2004, when Shell fell foul of SEC rules and was forced to reallocate a quarter of the assets on its books. The move led to steep fines, the ouster of its chairman and a plunging share price.

Three months ago the

SEC changed the rules to allow previously excluded resources such as tar sands to be classified as oil and gas reserves that, as with oil or gas, could be listed as probable, possible and proven reserves.

Previously, tar sands were defined as mining materials, and literally speaking they actually contain no oil in their natural state. Only by heating up the rock to boiling point, can any liquid be extracted. However, such large quantities of heat are required to obtain a usable fuel from the rock means that this is a far less efficient source of energy than conventional oil.

"The energy consumption required to extract a barrel from Canadian tar sands is very different to a barrel of crude from the Gulf of Mexico."said McGeveran. As oil prices rise, companies that use a lot of oil in ratio to the product they sell are obviously far more impacted by price rises. Tar sands mining has an input of 1 unit of fossil energy in for every 3.5 units of energy (their product) out. The lower this ratio, the more the cost of producing oil from shale will rise as fossil energy prices go up.

But mostly, this unusually high carbon method of extraction means that the climate impact of tar sands mining is much worse than that of regular oil and gas. So the move reflects changing attitudes among a very large group of mainstream investors about the impact of commercial activities that could worsen global warming. This group of institutional investors, among them the California Public Employees' Retirement System,

Ceres and Parnassus Investments have signed a letter of concern about the tar sands proposals and called for the new carbon implications to be taken into account.

Ceres president Mindy Lubber says that there is a need for financial institutions to evaluate these kind of projects with carbon prices that reflect their true long-term costs once carbon-reducing regulations take hold around the world.

"Much of the problem is our reliance on outdated accounting systems. Our economy uses accounting systems that are precise in measuring capital goods and profits, but weak in measuring natural and human resource impacts. This narrowly-defined accounting system means that companies are often able to "externalize" natural resource costs. In other words, they can emit global warming pollution for free without paying for environmental damage. Society and taxpayers shoulders these costs instead."

We're now seeing the capital markets begin to incorporate the external costs of global warming, especially in Europe where government-supported trading systems and pricing mechanisms for every ton of carbon dioxide emitted have fostered a $30 billion a year carbon emissions trading program. "

Therefore, filers of reserves should be required to provide investors with information about the carbon content of proven, probable and potential oil reserves in their portfolio as well as the potential liabilities posed by their continued extraction and use.

Photo

S. JoczFor

Matternetwork

Read more...

A new report published by Lloyd's and Risk Management Solutions warns that without adaptation, insurance losses from coastal flooding for high-risk properties could double by 2030.

A new report published by Lloyd's and Risk Management Solutions warns that without adaptation, insurance losses from coastal flooding for high-risk properties could double by 2030. Sen. Max Baucus (D-Mont.), chairman of the Senate Finance Committee, offered new hope this morning that House Democrats might now be more open to compromise in the wake of the defeat of a $700 billion Wall Street bailout package, which sent the stock market plummeting more than 700 points.

Sen. Max Baucus (D-Mont.), chairman of the Senate Finance Committee, offered new hope this morning that House Democrats might now be more open to compromise in the wake of the defeat of a $700 billion Wall Street bailout package, which sent the stock market plummeting more than 700 points.  Last week the Senate passed the

Last week the Senate passed the This afternoon, the House with its

This afternoon, the House with its  If you're like me ---and probably half the American work force, a computer is your workspace.

If you're like me ---and probably half the American work force, a computer is your workspace. A group of

A group of  On Thursday, Senator John McCain participated in an event sponsored by the Clinton Global Initiative in New York. He used the event to present himself as someone who is allied with Democrats like Gore and Clinton and other movers and shakers on clean energy.

On Thursday, Senator John McCain participated in an event sponsored by the Clinton Global Initiative in New York. He used the event to present himself as someone who is allied with Democrats like Gore and Clinton and other movers and shakers on clean energy.

While it's not the pleasantest prospect for a treehugger like me to dwell on, there is stuff we need to dig out of the earth, even to build the clean power economy.

While it's not the pleasantest prospect for a treehugger like me to dwell on, there is stuff we need to dig out of the earth, even to build the clean power economy. Here's another European EV we should be watching, now that GM's chairman has tipped us off on the inside dope (I'm hoping) on government plans to

Here's another European EV we should be watching, now that GM's chairman has tipped us off on the inside dope (I'm hoping) on government plans to  Products derived from tar sands, which have three times the carbon emissions of traditional gasoline, are a risky investment, because new low carbon fuel standards will increasingly close off sections of the American market.

Products derived from tar sands, which have three times the carbon emissions of traditional gasoline, are a risky investment, because new low carbon fuel standards will increasingly close off sections of the American market. Like most new startup companies, Miles EV is headquartered in a "Green" state: one that promotes innovation in the new green economy.

Like most new startup companies, Miles EV is headquartered in a "Green" state: one that promotes innovation in the new green economy.

While inventors three times his age are struggling with the constant effort to improve solar cell efficiency, one 12-year-old boy may have found the holy grail. Others improve current solar cell efficiency by 30 percent or forty percent, but young William Yuan, 12, has blasted that away with an efficiency improvement of an astounding 500 percent!

While inventors three times his age are struggling with the constant effort to improve solar cell efficiency, one 12-year-old boy may have found the holy grail. Others improve current solar cell efficiency by 30 percent or forty percent, but young William Yuan, 12, has blasted that away with an efficiency improvement of an astounding 500 percent! AutoblogGreen brings exciting news today about the next step for the California startup that shook up the auto industry with its successful launch this Spring of the all electric Tesla Roadster. But since none of us can actually afford that, we wait with baited breath to hear of the possible next steps for the company. Here it is.

AutoblogGreen brings exciting news today about the next step for the California startup that shook up the auto industry with its successful launch this Spring of the all electric Tesla Roadster. But since none of us can actually afford that, we wait with baited breath to hear of the possible next steps for the company. Here it is.

The Santa Ana based startup nano-tech firm

The Santa Ana based startup nano-tech firm  Nano metals present a clear opportunity to provide more energy and power density in zinc-air and lithium ion batteries when used as catalysts. Catalyst materials are the main ingredients facilitating chemical reactions within the battery and play a key role at setting the energy and power densities of these devices.

Nano metals present a clear opportunity to provide more energy and power density in zinc-air and lithium ion batteries when used as catalysts. Catalyst materials are the main ingredients facilitating chemical reactions within the battery and play a key role at setting the energy and power densities of these devices.

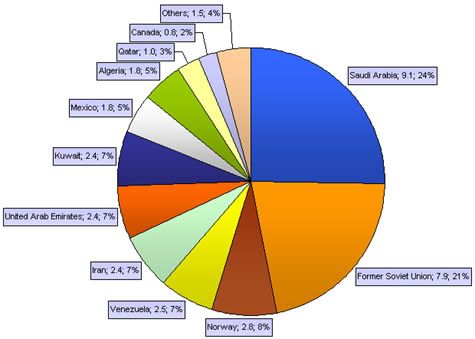

Most people are familiar with the figures on US share of world oil consumption versus world oil production: that we produce a mere 3 percent, but consume 25 percent of world oil supplies.

Most people are familiar with the figures on US share of world oil consumption versus world oil production: that we produce a mere 3 percent, but consume 25 percent of world oil supplies.

Obama's

Obama's