When the farsighted French Wind Financier Jerome Guillet started his predictive series countdown to $100 oil, I found it curious that gas prices at the pump did not initially reflect the rising oil prices. As oil prices kept creeping up, doubling the $30 a barrel prices we had grown used to, to surpass $60 and even $70 a barrel, prices at the pump remained strangely unresponsive.

But there did come a tipping point. Gas prices at the pump finally reflected the ever increasing oil prices, and then interesting things happened: - SUV resale values plummeted $8000 in 6 months, US automakers retooled to build cars instead of trucks, Mini Cooper inventories shrank to one-day supplies on the lot and the US accident rate dropped 9% as Americans sharply curtailed their driving habits.

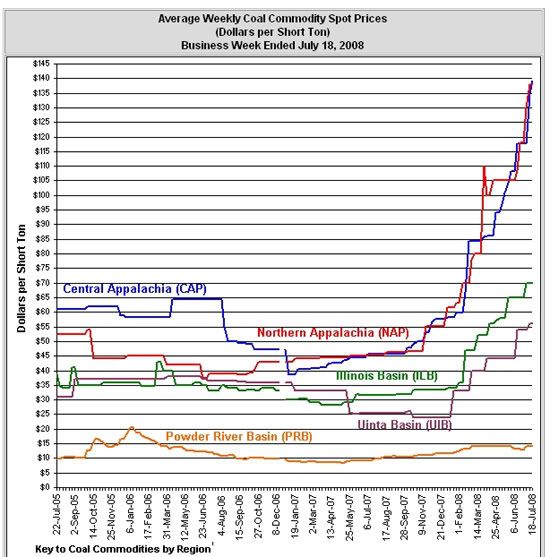

Now, international pressures have pushed coal prices to a record-breaking $140 a ton.

I wonder... at what point in the next few years will rising electricity costs yield similarly interesting changes in our behavior?

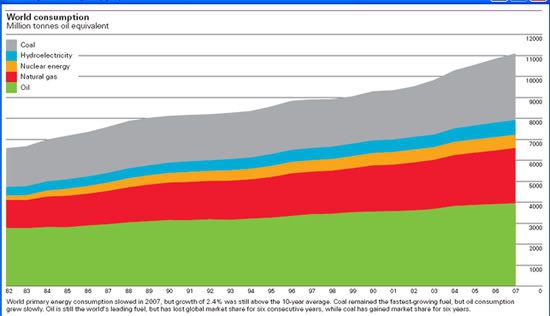

Could the other 6 billion electricity consumers competing for our electricity supply change what Al Gore couldn't?

Might it simply become normal behavior to protect our own electricity supply? Just as responsible parents buy insurance to protect our families' futures, might it simply become the normal, responsible thing to do to ensure the family electricity supply by finally putting up that solar roof?

Appalachian Coal Prices Hit $140 Per Ton

From Appalachian Voices Front Porch Blog and the EIA

Other Sources

SUV Resale Rates Plummet $8000 in 6 Months

US Automaker Retools To Build Cars Instead Of Trucks

Mini Coopers Hit One Day Supply in July

Vehicle Accident Death Rate Drops 9%

82% of US Consumers Driving Less In Response To High Gas Prices